When bitcoin adoption reaches a worldwide scale, it is most likely there will no longer be bitcoin podcasts, bitcoin conferences and even, sorry to state this, a requirement for a Bitcoin Magazine. However, up until this point, individuals thinking about bitcoin will be separated from those who are yet to start their journey down the bitcoin bunny hole. The concern is then raised, how does a bitcoiner explain themselves to others, that may assist bridge the gorge in between their own understanding and those still plugged into The Matrix?

Given the inflationary policies of succeeding federal governments, internationally (see Rune Østgård exceptional book Fraudcoin for more details), almost everybody with resources has actually needed to end up being an “investor” merely to try to preserve acquiring power overtime.

People who wish to own the location they live, have the capability to personalise where they invest their time, and (for the a lot of part) not be worried about expulsion or undergo extreme expenses of leasing, ought to not need to see themselves as financiers. However, due to financial premia commanded by property, not just do individuals require to take dangers by leveraging their properties to acquire homes (through home loans), they might also require to hypothesize that in the future, the worth of their home will have increased adequately to balance out the expenses sustained of buying, moving and cover the interest on their financial obligation.

Alongside the requirement to develop wealth through “hard assets” such as residential or commercial property, the non-bitcoiner will be directed and typically supported in preparing for the future through more financial investments in the type of a pension. While tax effectiveness and, for those fortunate enough, extra company contributions assist to increase advantages, the financial investment associated dangers are lowered. However, these advantages also require to be comprehended in relation to the counterparties included, such as modifications in federal government policy, modifications in pension plans or the worst-case circumstance of the business offering the pension experiencing monetary troubles. Learning that the pension you have actually been paying into for thirty years now has no worth through no fault of your own is rather merely heartbreaking to view.

Since the general public recognition by Blackrock that bitcoin might not in fact be an “index of money laundering”, bitcoin as a financial investment grade property is ending up being an accepted story. This might indicate that bitcoin can start to be thought about together with equities, property and pensions as a method on keeping acquiring power while also preparation for the future. However, recalling, this understanding might merely be a point on an ever altering journey, from its origins within an unfamiliar Cypherpunk subscriber list that saw it as a collectible, through the medium of exchange on the Silk Road to where we are today. With an eye on the future, it might be sensible to start considering what description will follow for somebody who owns bitcoin, that will make more sense in the future aside from an “investor”. The really nature of bitcoin also recommends that it differs from other properties (either products or securities), implying that it may be incorrect to see it as either.

Unfortunately, constant with awareness of bitcoin not being even dispersed, openly held views of the property are also rather irregular. As just recently as May, 2023, Harriet Baldwin MP, of the UK Parliament Treasury Committee suggested that “unbacked ‘tokens’” (consisting of bitcoin), ought to be managed as “gambling rather than as a financial service”. While this is mostly real for “cryptoassets” more broadly, this is merely incorrect in relation to bitcoin, provided it is backed by the world’s biggest computer system network running a procedure that is very resistant to alter. The nature of the bitcoin procedure suggests that unlike property or pensions, modifications in federal government, organisational policies or an organisation’s efficiency cannot impact its operation or energy in the future. In mix with this, provided the repaired supply of bitcoin, it is also exempt to debasement through inflationary policies that impacts the system of represent other properties.

As a repercussion, while previous information reveals the dollar worth of bitcoin is extremely unpredictable (affected by supply and need characteristics), the dangers connected with the property itself are in fact very low. When this is integrated with the capability to self-custody the property, at low expense, more dangers are eliminated when compared to the requirement for shares in business or product certificates to be custodied by brokerage companies.

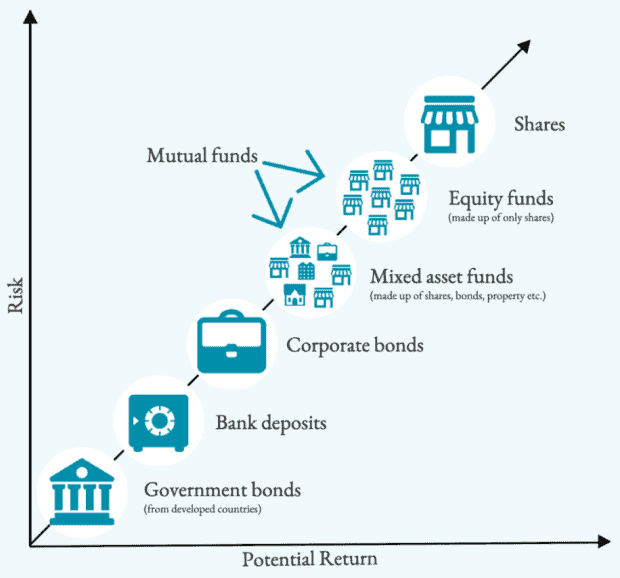

Standard meanings of investing focus upon an expectation that cash invested will grow, despite the fact that any educated financier will do this by stabilizing the prospective development versus any involved dangers. From the treasury committee’s perspective, the dangers and returns connected with betting would likely find bitcoin beyond the leading right corner of the figure below.

From the point of view of purchasing bitcoin being comparable in nature of betting, offering a fiat currency for bitcoin, with an opportunity, instead of an expectation of development might then recommend that bitcoin might not in fact have the ability to be classified as a financial investment.

To more concern the above figure, times appear to have actually altered from when this reputable concept was established, speeding up the requirement for reflections on formerly held presumptions. Government bonds are no longer “risk free”, shown by the worldwide rate of interest increases leading to remarkable losses in the worth of federal government bonds in 2022. This circumstance has actually then affected the dangers connected with bank deposits, resulting in current failures of big banks in the United States. In contrast to both federal government bonds and bank deposits, the security of bitcoin is neither subjected to reserve bank rates of interest policy danger nor third-party dangers connected with the holders of federal government bonds (even if the short-term worth might alter). Given the repaired emission schedule of bitcoin, it is also exempt to “money printing” and federal government deficits that have actually lowered the acquiring power of the underlying currency, as promoted by Modern Monetary Theory.

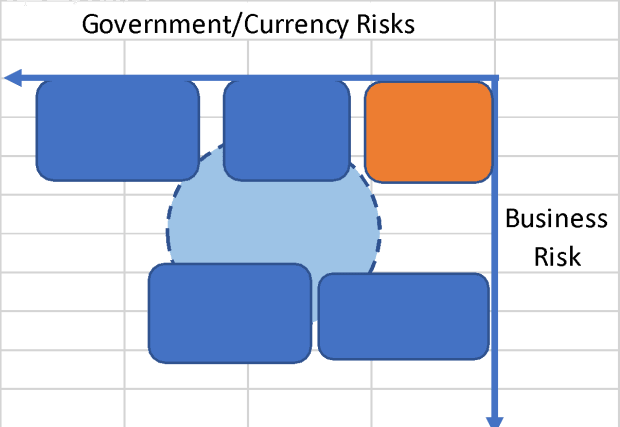

Fascinatingly, in a current file from Blackrock, this contrarian perspective is supported, recommends a bitcoin allowance of 84.9% within a financial investment portfolio, representing an extremely various danger profile when compared to other properties (Thank you Joe). Aside from the volatility connected with markets trying to price a brand-new property, this recommends that bitcoin is where Blackrock would advise holding most of your wealth. The figure below hence recommends an alternative framing when comparing bitcoin to other properties, where rather of providing rois, attention is offered to the dangers of the underlying system of account (fiat currency) versus business danger.

Within the present high inflation environment, currency and company associated dangers are increased. History then supplies a sobering point of view on the effect of inflation on the wellness of a population (see When Money Dies). During Weimar Germany, as an outcome of the problems with the currency, those who invested knowledgeable durations of favorable returns, however were later on messed up as run-away inflation took hold. In this context, instead of purchasing gold, those who merely conserved in it might ride out the unpredictable cost motions. In a remarkable echo, the exact same has actually been shown in Argentina today with bitcoin. Investors or traders are most likely to have actually lost cash, however in the long term, conserving in bitcoin has actually been a better choice for the average Argentinian.

So yes, I am a bitcoiner, however that does not indicate I am a financier, speculator, bettor or a criminal and while I’d like to be, I’m also not a Cypherpunk. I am merely somebody working towards a much better future for myself, my household and perhaps even their households. Bitcoin appears to supply a method of moving the worth of my work today into the future, without the dangers of it being mishandled (equities), enacted laws versus (pensions), at danger of reserve bank policy (federal government bonds and fiat currencies) or struck by lightning (property). As an outcome, bitcoin might not be a financial investment and is just a speculation or gamble if you buy it without understanding it.

To go back to the title, when inquired about themselves and how they are preparing for the future, a bitcoiner can merely state, “I’m staying humble, appreciating I have a lot to learn but saving the best asset I can find” (see Mickey’s work for a macro perspective). Hopefully, this will stimulate their interest, so result in the follow up concern of “can you tell me more?”. At which point, the orange pilling can start.

This is a visitor post by Rupert Matthews. Opinions revealed are totally their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.