Introduction

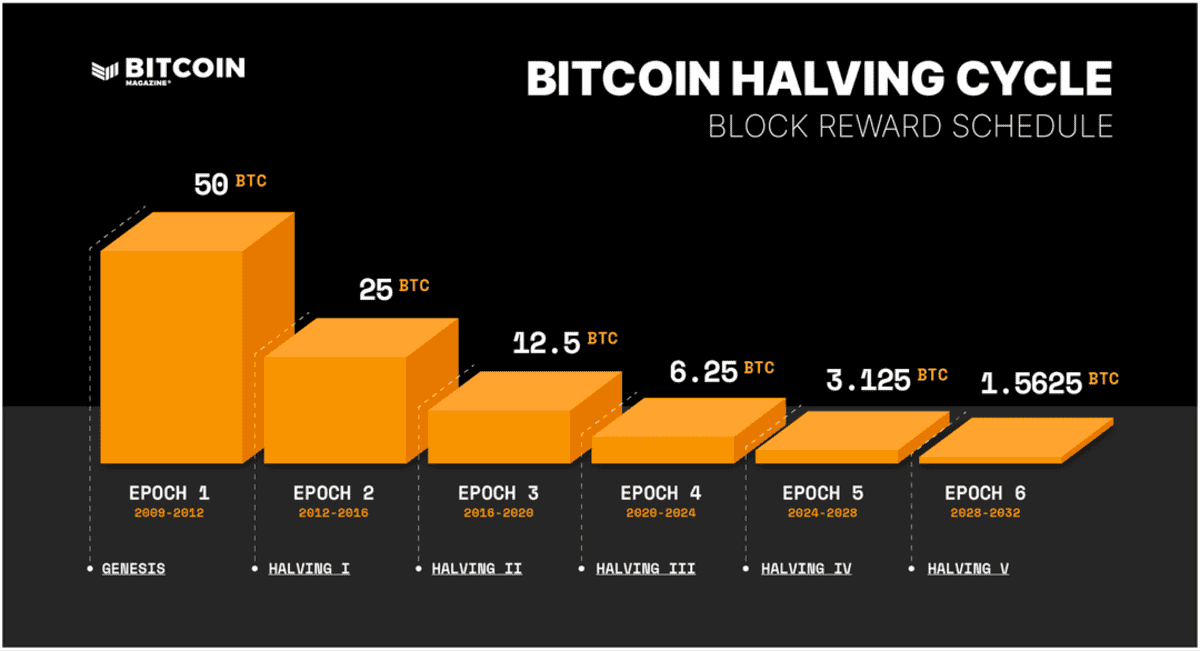

As we approach the conclusion of the 3rd date, the countdown to the next Bitcoin halving is securely underway. The halving (also called the “Halvening”) is among the essential and ingenious functions of Bitcoin. Every 10 minutes, the Bitcoin network problems brand-new bitcoin and around every 4 years (every 210,000 blocks, to be exact) the quantity released (the “block subsidy”) is halve. The obstruct aid is the benefit miners get for confirming and tape-recording brand-new deals on the blockchain.

The halving of the obstruct aid is a vital consider bitcoin’s ultimate capped supply of 21 million bitcoin. In addition, miners also gather deal charges that users connect to their deals to motivate miners to include them in the next block. Therefore miners frequently make more bitcoin for mining a block than simply the aid. .

WHEN IS THE NEXT BITCOIN HALVING?

The next Bitcoin halving is prepared for to happen on or around April 20, 2024 EST, decreasing the block benefit from 6.25 to 3.125 BTC. This cutting in half duration — or epoch — will increase the supply by 164,250 bitcoin (from 19,687,500 to 20,671,875), a simple 328,124 bitcoin from the optimum supply limitation of 21 million.

TO COMPUTE THE NEXT CUTTING IN HALF DATE

- Determine the block period: While it’s true that Bitcoin’s block time (the time in between each block) is around 10 minutes, the time can differ a little due to hash rate and network changes.

- Find the present block height: You require to understand the present block height, which you can discover on different blockchain explorer sites or straight from your Bitcoin node if you’re running one.

- Calculate the obstructs staying till the next halving: Bitcoin’s halving takes place every 210,000 blocks. Subtract the present block height from the next cutting in half block height.

- Calculate the approximated time staying: Multiply the variety of blocks staying by the approximate block period (in seconds) to approximate the time staying till the next halving.

- Convert the time into a date: Convert the approximated time staying into a date format to discover when the next halving is anticipated.

Current block height: can be discovered here.

Block time: can be discovered here.

Current date: xx/xx/xxxx

Blocks per date: 210,000

Next cutting in half block height: 210,000 times next cutting in half number

Calculation:

(((Next Halving Block Height – Current Block Height)*10)/60)/24 = Days staying

Hash rate and trouble modification are 2 variables which continuously shape the speed at which blocks are processed and for that reason the periods in between blocks. The date of the next cutting in half can differ as an outcome, so it’s important to keep running the estimation.

HISTORY OF BITCOIN HALVINGS

As of March 2024, there have actually been 3 Bitcoin halvings:

- On November 28, 2012, Bitcoin’s block aid reduced from 50 BTC per block to 25 BTC per block.

- On July 9, 2016, the 2nd Bitcoin cutting in half reduced the block aid from 25 BTC per block to 12.5 BTC per block.

- On May 20, 2020, the 3rd Bitcoin cutting in half minimized the block aid from 12.5 BTC per block to 6.25 BTC per block.

BITCOIN HALVING 2012

The 2012 halving was Bitcoin’s very first halving.

Halving:

Date: November 28, 2012

Halving number: 01

Block height: 210,000

Block benefit: 25

Mined supply: 10,500,000 (quantity of bitcoin currently released when the cutting in half took place)

Epoch:

Subsidy: 5,250,000

Percentage of mined supply: 25%

BITCOIN HALVING 2016

The 2016 halving was Bitcoin’s 2nd halving.

Halving:

Date: July 9, 2016

Halving number: 01

Block height: 420,000

Block benefit: 12.5

Mined supply: 15,750,000 (quantity of bitcoin currently released when the cutting in half took place)

Epoch:

Subsidy: 2,625,000

Percentage of mined supply: 12.5%

BITCOIN HALVING 2020

The 2020 halving was Bitcoin’s 3rd halving.

Halving:

Date: May 20, 2020

Halving number: 03

Block height: 630,000

Block benefit: 6.25

Mined supply: 18,375,000 (quantity of bitcoin currently released when the cutting in half took place)

Epoch:

Subsidy: 1,312,500

Percentage of mined supply: 6.25%

BITCOIN HALVING 2024

The 2024 halving will be Bitcoin’s 3rd halving.

Halving:

Date: April 20, 2024 (approximated)

Halving number: 04

Block height: 840,000

Block benefit: 3.125

Mined supply: 19,687,500 (quantity of bitcoin released when the cutting in half took place)

Epoch:

Subsidy: 656,250

Percentage of mined supply: 3.125%

FUTURE BITCOIN HALVINGS

The blocktime variable will present some difference in approximated halving dates, however it is possible to job approximate dates till the conclusion of block aids in 2140. Below, we offer a concise summary of awaited halving dates from 2024 to 2060, using important insights into these upcoming turning points.

HISTORIC RAMIFICATIONS OF THE BITCOIN HALVING

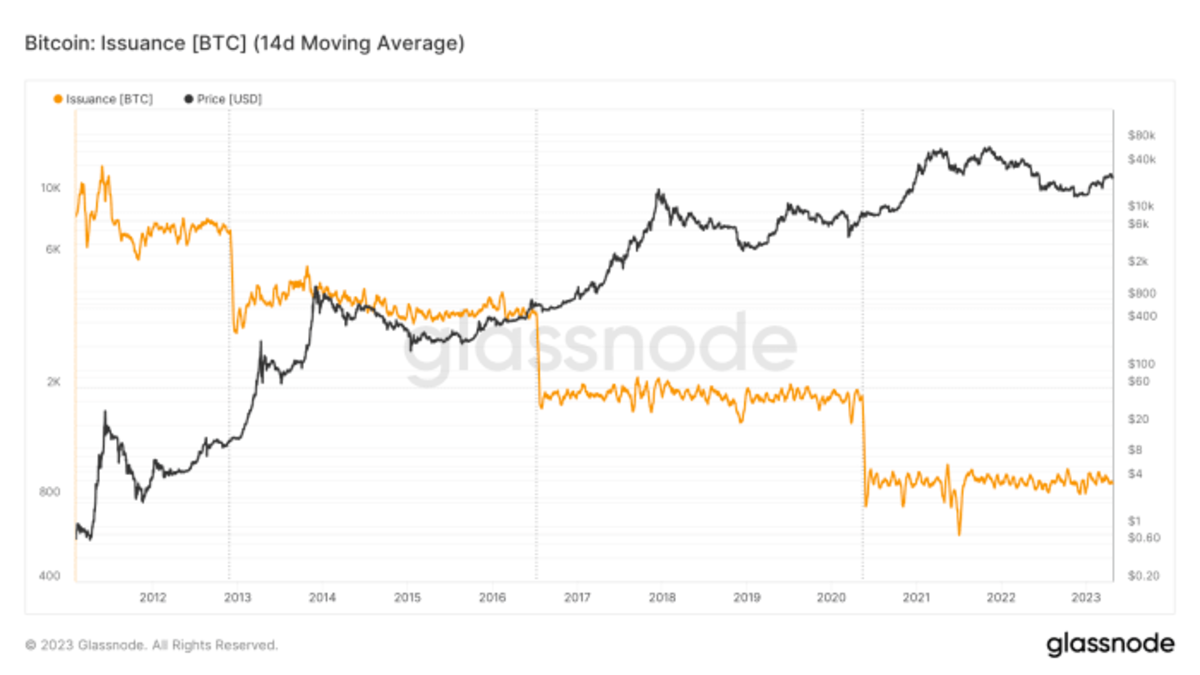

Halving occasions have actually regularly preceded considerable boosts in bitcoin’s rate, making them a centerpiece for market experts.

Price Appreciation

Historically, bitcoin’s rate has actually experienced considerable increases following cutting in half occasions due to the mix of minimized supply and increased need. These occasions significantly affect the total supply of bitcoin, consequently impacting its rate. Nevertheless, it is vital to acknowledge that the rate characteristics are affected by lots of elements beyond cutting in half occasions.

- After the 2012 halving, the bitcoin rate increased around 9,000% to $1,162.

- After the 2016 halving, the bitcoin rate increased around 4,200% to $19,800.

- After the 2020 halving, the bitcoin rate increased around 683% to $69,000.

Bitcoin issuance rate gets minimized in half approximately every 4 years.

Challenges for Miners

Halving occasions can posture obstacles for miners, as their earnings reduces when block benefits are halved. To stay competitive, miners should run effectively, possibly driving the advancement and adoption of more energy-efficient mining innovation. It is rather typical for miners to declare bankruptcy, which frequently affects the network’s hash rate, the supply of offered for-sale bitcoin, and eventually bitcoin’s rate. Through the turmoil, the trouble modification ultimately brings back stability and the Bitcoin network and community continues to march forward.

Frequently Asked Questions:

Will Bitcoin increase at the cutting in half?

Bitcoin’s historic efficiency after a cutting in half occasion has actually revealed an amazing upward trajectory. The decrease in the rate of brand-new supply is Bitcoin’s course to outright shortage. This occasion frequently stimulates increased interest and need. However, it’s important to work out care and not view the halvings as ensured courses to fast earnings. The sensible method is to comprehend the long-lasting capacity of bitcoin and consider it as a shop of worth instead of trying to time the market with trading.

Is Bitcoin cutting in half bullish?

The Bitcoin halving is absolutely a bullish occasion, as it moves the supply characteristics in favor of rate gratitude. While the halving is usually viewed as a bullish occasion, it’s a good idea to keep in mind that bitcoin’s rate is affected by numerous elements. Caution is encouraged.

How lots of days after Bitcoin cutting in half does it struck its peak?

A take a look at the past 3 cutting in half occasions reveals that a considerable rate increase typically starts within a couple of months of the cutting in half occasion. Also, before a cutting in half occasion, the rate of bitcoin tends to increase as financiers prepare for a rate rally post-halving. After the halving, the rate typically takes control of 12 months to reach its peak.

Should you purchase bitcoin before the cutting in half?

Instead of attempting to comprehend when to purchase and offer bitcoin, it’s recommended to comprehend the worth of the possession. That stated, a pattern has actually played out in the past where purchasing 6-12 months before the cutting in half and offering 12-18 months after the cutting in half tends to return a substantial earnings. Past efficiency and habits is not an assurance of future efficiency. Our finest recommendations to those who are not knowledgeable traders would be to purchase and hold for lots of cycles.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.