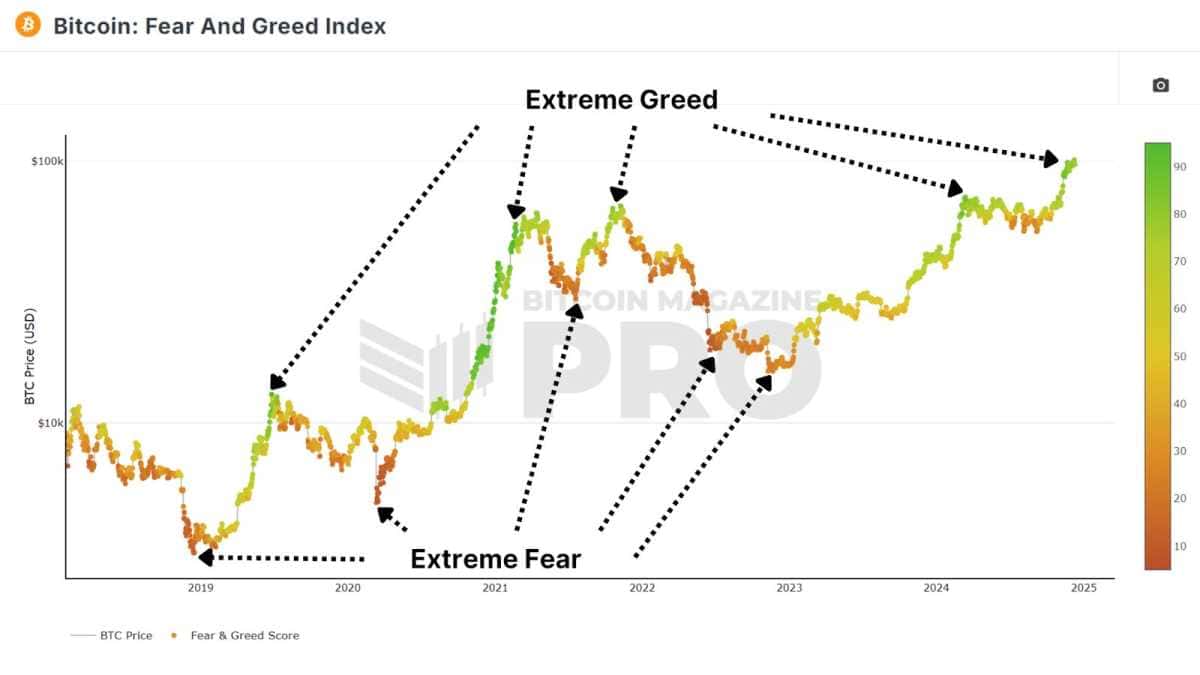

The Bitcoin Fear and Greed Index serves as a sentiment evaluation instrument designed to seize the collective temper amongst Bitcoin merchants and buyers. This index operates on a scale starting from 0 to 100, categorizing market feelings from excessive concern (0) to excessive greed (100). Although it has gained reputation amongst varied analysts, there exists a notable diploma of skepticism surrounding its efficacy. Therefore, an examination of the info is warranted to establish whether or not this index can certainly help buyers in making improved funding selections.

Investor Emotion

The Fear and Greed Index compiles an array of metrics to supply a complete overview of market sentiment. The key metrics contributing to this index embody:

Price Volatility: Significant worth fluctuations typically induce concern, significantly throughout market downturns.

Momentum and Volume: An enhance in shopping for exercise usually signifies a sentiment of greed.

Social Media Sentiment: The discourse surrounding Bitcoin on social media platforms sheds mild on collective optimism or pessimism amongst buyers.

Bitcoin Dominance: A better dominance of Bitcoin in relation to altcoins usually displays a extra cautious market outlook.

Google Trends: The degree of public curiosity in Bitcoin-related search phrases serves as an indicator of general sentiment.

By synthesizing these varied knowledge factors, the index presents a simplified visible illustration whereby pink zones signify concern (decrease values) and inexperienced zones point out greed (larger values).

View Live Chart 🔍

The index notably illustrates the precept that mass psychology typically lends itself to contrarian methods. In observe, when market sentiment is predominantly bearish, it might be prudent to undertake a extra bullish stance, and conversely.

Evaluation of Contrarian Strategies

To decide the sensible efficacy of the Fear and Greed Index, a historic evaluation was performed using knowledge commencing from February 2018, the date of the metric’s inception. The technique employed was easy:

Allocate 1% of 1’s capital to Bitcoin on days when the index registers 20 or below, and divest 1% of Bitcoin holdings on days when the index peaks at 80 or above. If such a rudimentary technique yielded favorable outcomes, it could possibly be categorised as a helpful instrument for buyers.

The Results

This technique significantly outperformed a commonplace buy-and-hold method. The Fear and Greed Strategy achieved a return on funding (ROI) of 1,145%, in distinction to the 1,046% ROI noticed in a Buy & Hold Strategy over the identical timeframe. Although the disparity might not be monumental, it nonetheless underscores the potential for enhanced returns by means of a measured method to investing in Bitcoin, guided by market sentiment.

The underpinnings of the Fear and Greed Index lie within the realm of human psychology. Markets are liable to overreacting in each instructions; thus, the technique of performing counter to those extremes successfully capitalizes on irrational and emotional market behaviors. By step by step growing publicity when concern prevails and lowering it when greed dominates, buyers can handle dangers whereas enhancing profitability, thus outperforming one of many world’s highest-performing belongings.

It is essential to notice that the success of this technique hinges on disciplined commerce administration, specializing in gradual entry and exit over macroeconomic cycles. It doesn’t account for potential charges or tax liabilities. Furthermore, market situations can stay irrationally fearful or grasping for prolonged durations, and trying to make vital changes to publicity primarily based solely on this metric might not yield long-term success.

Conclusion

Despite its obvious simplicity, the Fear and Greed Index has demonstrated its worth when utilized judiciously. It aligns with the adage of “buy when others are fearful, and sell when others are greedy,” a precept that has guided quite a few profitable buyers.

The Fear and Greed Index ought to be employed along with different analytical instruments, together with on-chain knowledge and macroeconomic indicators, to reinforce decision-making. However, the info introduced helps the view that this index is a metric worthy of consideration in funding analyses.

For these fascinated by a extra complete exploration of this topic, a current YouTube video titled “Does The Bitcoin Fear & Greed Index ACTUALLY Work?” is accessible for viewing.

To keep knowledgeable about Bitcoin’s worth motion and entry dwell knowledge, charts, indicators, and in depth analysis, Bitcoin Magazine Pro presents a helpful useful resource.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.