In the modern financial landscape, knowledgeable investors are reassessing their portfolios and checking out the practicality of Bitcoin as a practical option to traditional properties such as property. Given its limited supply and substantial development capacity, Bitcoin provides a convincing argument for ingenious financial investment methods.

Real Estate: The Myth of Stability

Traditionally, property has actually been viewed as a safe methods of wealth conservation. Nevertheless, the real estate market is prone to systemic threats, consisting of rate of interest variations, federal government interventions, and financial recessions. Additionally, home financial investments usually sustain considerable upkeep expenses, taxes, and restraints on liquidity.

In contrast, Bitcoin offers unequaled mobility, durability versus confiscation, and resistance from regional financial or geopolitical disruptions. Unlike property, Bitcoin sustains no upkeep expenditures and is devoid of physical constraints.

The Emergence of Bitcoin as a Store of Value

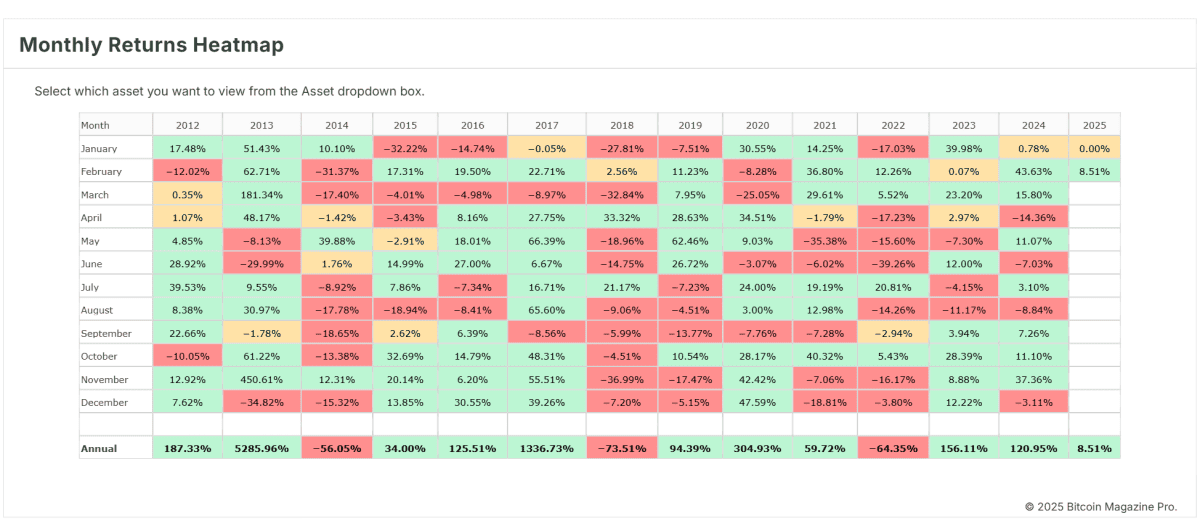

Bitcoin’s repaired supply of 21 million coins positions it as “digital gold” for the 21st century. Over the last years, Bitcoin has actually regularly outshined different possession classes, yielding rapid returns regardless of its intrinsic volatility.

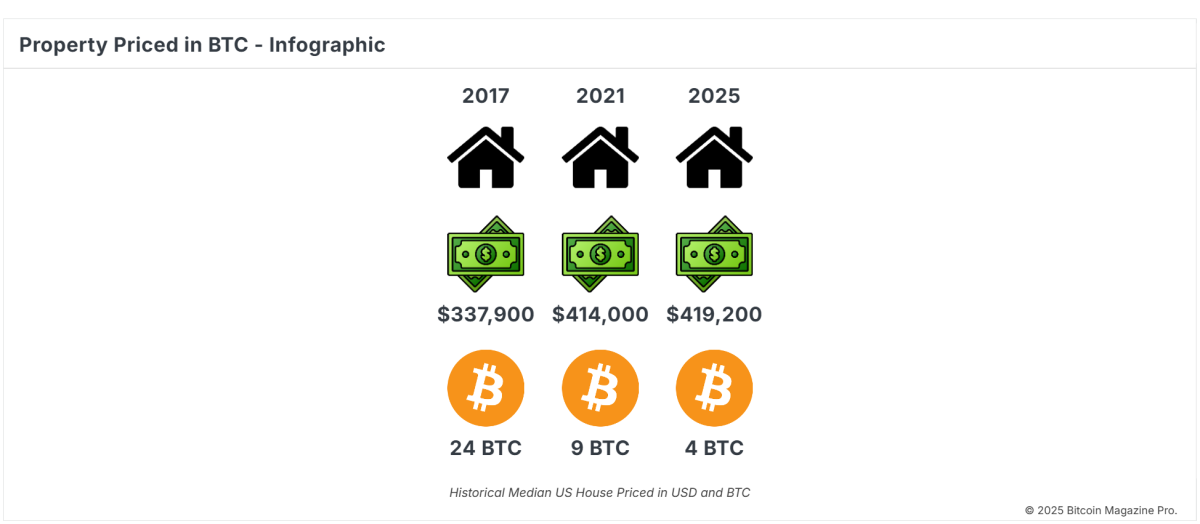

In contrast, the gratitude of property is typically carefully connected to inflation and governmental financial policies, which can possibly deteriorate its intrinsic worth in time. Conversely, Bitcoin abides by a deflationary design, ensuring deficiency and the conservation of buying power.

Liquidity and Accessibility

Investments in property regularly include lengthy deals, considerable costs, and considerable regulative challenges. The procedure of offering a residential or commercial property can extend for months, efficiently immobilizing capital and restricting versatility. Bitcoin, nevertheless, uses instant liquidity and can be traded 24/7 throughout international exchanges, therefore empowering investors to move their wealth without barriers.

The information shows Bitcoin’s capability to protect and enhance wealth better than standard home financial investments.

Hedging Against Inflation

Real estate worths usually show inflationary patterns without substantially exceeding them. In contrast, Bitcoin is developed as a hedge versus the decline of fiat currencies and has actually shown durability throughout inflationary durations. As reserve banks continue to embrace unmatched levels of financial growth, Bitcoin’s limited supply guarantees that its worth stays secured versus financial debasement.

Flexibility for Modern Investors

Contemporary investors position a premium on versatility and international availability. Conversely, property is defined as a localized and illiquid possession that limits individual movement. Bitcoin, on the other hand, goes beyond borders and assists in decentralized ownership without dependence on traditional monetary systems. This particular holds specific appeal for more youthful, tech-savvy investors who focus on autonomy and control.

A Vision for the Future

Bitcoin goes beyond being simply a speculative possession; it embodies a monetary transformation. By embracing Bitcoin, astute investors align themselves with the leading edge of this transformative shift. As Bitcoin’s adoption continues to broaden, its worth proposal ends up being significantly apparent: a robust, deflationary possession carefully developed for the contemporary economy.

Conclusion

While property has actually traditionally formed a foundation of financial investment portfolios, Bitcoin uses a transformative option that lines up with the needs of a progressively vibrant international economy. For investors looking for to protect wealth, hedge versus inflation, and take advantage of cutting-edge innovation, Bitcoin becomes the possession of option. The significant query is no longer “Why Bitcoin?” however rather “Why not Bitcoin?”

For those thinking about extensive analysis and real-time information, it is suggested to check out Bitcoin Magazine Pro for important insights into the Bitcoin market.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.