One of the main worth proposals of Bitcoin is that no matter what occurs, if you pay a high adequate cost some miner out there worldwide will verify your deal. In other words, Bitcoin is censorship resistant. There is a great factor that the expression “censorship resistant” is the phrasing you hear whenever this subject shows up, not “censorship proof.” Any private miner can censor whatever they desire, in the sense that they can decline to consist of something in any block they mine themselves. They cannot, nevertheless, avoid other miners from consisting of that deal in their own blocks whenever they discover one.

Bitcoin is resistant to censorship, however it is not unsusceptible to it. Any miner can censor whatever they desire, which is totally free, overlooking obviously the prospective chance expense of profits loss if there are insufficient deals readily available paying an equivalent feerate to the deal(s) they pick to censor. But this doesn’t stop the worldwide system from processing that deal anyhow, unless those miners 1) consist of a bulk of the whole network hashrate, 2) pick to take advantage of that truth to orphan the block of any miner who selects to process the deal(s) they want to censor.

To do this would lose most of miners participating in the orphaning attack cash as long as the minority set of miners continued mining blocks that consisted of the “verboten” deal. Each time such a block was discovered, it would basically increase the time up until the next block that made it into the chain was discovered, reducing most of censoring miners’ earnings typically. This would stay the case up until the minority quit and capitulated or was lacked service (as they would be passing up profits on any block consisting of the censored deal also).

For now, let’s presume that this circumstance is not in the cards. If it were, Bitcoin is either a failure, or should exist in this state up until non-censoring miners have the ability to silently generate adequate hashrate in order to subdue the existing bulk intent on orphaning blocks including deals they do not desire validated in the blockchain.

So what occurs when a set of miners, in the minority, choose they are going to censor a particular subset of deals from their blocks? The quantity of blockspace that is readily available to those deals diminishes. There is less blockspace readily available to them than every other class of deals. What is completion outcome of this? Fee pressure for this class of deals will strike saturation faster than every other class of deals.

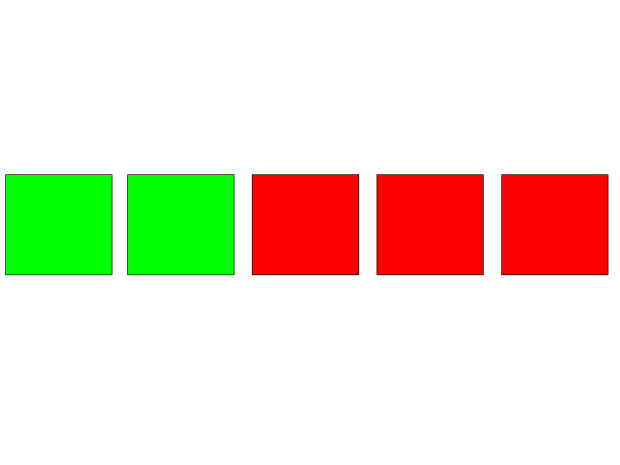

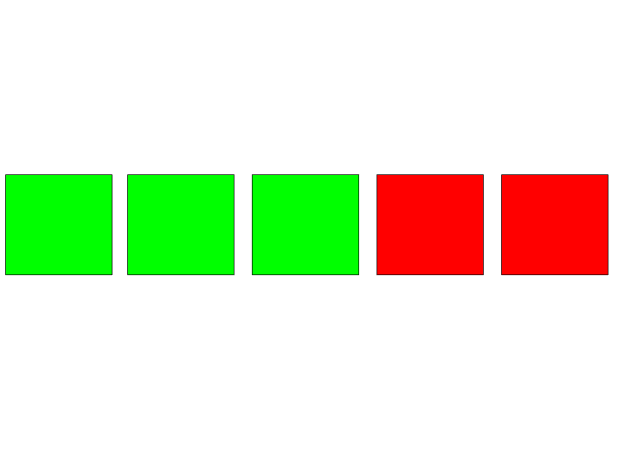

Just for the sake of simpleness in the example, envision it just takes 10 deals to fill any offered block. We’ll call routine deals just “regular transactions”, and the deals being censored “verboten transactions.” Each day there are on typical 5 blocks discovered, and there are 5 miners. The red blocks represent miners who will not mine verboten deals, and the green blocks are miners who will. For routine deals to fill the readily available blockspace and begin increasing charges, there requires to be 50+ deals pending in order for the bidding craze to start increasing charges and increasing the profits for miners. At this point the cost created profits for all miners will start increasing.

For the verboten deals, just 20+ deals require to be pending in order for a bidding craze to start among them, increasing cost earnings. But the cost profits from the verboten deals will just be gathered by the green miners.

In a circumstance where the verboten deals are not saturating mempools in excess of the block capability readily available to them, all miners will make the exact same rough level of earnings. Those verboten deals should take on routine deals in order to have some assurance of prompt verification, so if routine deals are saturating the mempool however verboten deals are not the total cost pressure will be fairly uniformly dispersed among all miners and nobody will have any out of proportion cost profits not available to the others.

However, if verboten deals are saturating the mempool in excess of the readily available blockspace, that cost pressure will increase charges paid by verboten deals just for the green miners. Having chosen to censor these deals, red miners will not be understanding any increased cost profits from the verboten deals. Regular deals in this circumstance will not need to take on verboten deals in feerates unless they require to verify in the next block, so the indirect feerate increase in routine deals since of verboten deals’ cost pressure will not cause a comparable boost in profits for red miners.

This disequilibrium leaves green miners making more profits per block/hash than red miners. This is, incentivize sensible, undoubtedly unsustainable. One of 2 things will take place gradually: 1) either the green miners will reinvest the additional profits they are getting and broaden their portion of the hashrate, or 2) miners will problem from the red side and the green set of miners will grow in portion of the hashrate that method.

This dynamic of greater charges for green miners will lead to the development of the hashrate of green miners, despite whether through reinvestment or defection from red miners, up until it reaches a stability where the verboten deals’ blockspace need levels off with routine deals, and both groups of miners are making approximately the exact same earnings. This stability will last up until the verboten deals’ need for blockspace surpasses that readily available to them, and after that the whole dance of green miners making more up until they grow in network hashrate share to a stability point of equivalent cost profits once again.

This vibrant is why Bitcoin is censorship resistant. Not since all miners are not efficient in censoring something, however since miners are incentivized to consist of something other miners are censoring through market characteristics. If some miners censor a class of deals, they reduce the quantity of blockspace readily available to them and increase the charges they want to pay. Pure and easy. Unless miners are totally unreasonable, in which case Bitcoin’s whole security design is brought into question, some will consist of these deals and make the additional profits.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.