Bull runs resemble wildfires: they require a mix of conditions to get going.

A wildfire requires an extended period of no rain, heats and after that high winds at the point of ignition.

Yes – wildfires have actually been worsened by record methane emissions that Bitcoin assists reduce, however that’s not what this short article’s about: this time it’s simply an example.

Halvings trigger a drying up of new supply of Bitcoin (no rain). They draw increased interest in timing Bitcoin market entry (heat). But they also require high winds and an ignition occasion.

That high wind is the winds of modification around the Bitcoin ESG narrative.

The ignition occasion will be the very first big ESG Investment Committee support Bitcoin for ESG factors.

The Problem The Soaring Volume Of ESG Investors Have

By 2026, ESG-focused institutional financial investment will have soared to 33.9 trillion dollars. That’s more than more than $1 for each $5 of possessions under management according to a PwC report.

But the more crucial takeaway from the report that need to notify Bitcoin hodlers present and future is that today ESG financiers have an issue: need for strong ESG financial investment overtakes supply. ESG financiers take a long period of time to discover appropriate ESG financial investments, with an extremely high 30% of financiers stating they battle to discover appealing ESG financial investment chances.

Bitcoin is now in lead to address that issue. Here’s why:

The Opportunity For Bitcoin

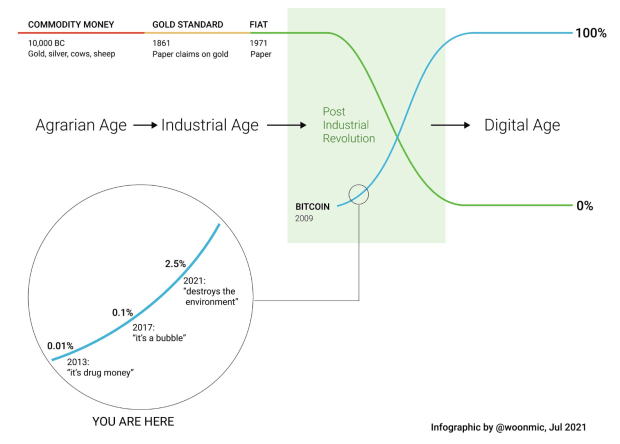

2023 marked the turning of the tide in the ESG narrative around Bitcoin.

In simply 53 halcyon days from Aug 1-Sept 22 this year, 5 occasions assisted turn the Bitcoin ESG narrative. They were:

1. KPMG Report concludes that Bitcoin supports the ESG vital (1 Aug)

2. Peer evaluated research study supports thesis Bitcoin can be great for environment (8 Aug)

3. Cambridge acknowledges Bitcoin energy overestimation (30 Aug)

4. Bloomberg Intelligence charts reveal Bitcoin mining leading decarbonization (14 Sept)

5. Institute of Risk Management conclude Bitcoin assists sustainable shift (22 Sept)

These reports and documents were produced individually, from extremely trusted scientists and companies, and instead of conclude Bitcoin is “not as bad for the environment as we thought”, they reached the much more powerful conclusion that Bitcoin was net favorable as an ESG possession.

This wind of modification has the prospective to heighten into the high wind that Bitcoin requires to finish the set of conditions required for a bull run.

What This Means

Information is power. Right now, there is an info asymmetry. The narrative has actually altered based upon new information. But most ESG financiers don’t have this information. Yet. Until they get this new information, they’ll keep thinking the old “Bitcoin is net negative for the environment” narrative.

In case we required proof of that, here’s a DM I received from a fund supervisor simply recently.

This kind of ESG financier still cannot release a greater portion into Bitcoin since their ESG details on Bitcoin is a number of years out of date, and are not yet familiar with the 5 narrative-flipping occasions explained above.

While the Bitcoin-views of ESG Investment Committee members are frequently highly unfavorable, it has actually been my experience that unlike ecological NGOs, their views are also loosely held. When I remained in Sydney just recently, a young Australian enthusiastically bounded up me and stated “Dan – I used your charts to orange-peel our investment commeettee!”

So what will take place when this details asymmetry is blown away by the high winds of the new Bitcoin ESG narrative?

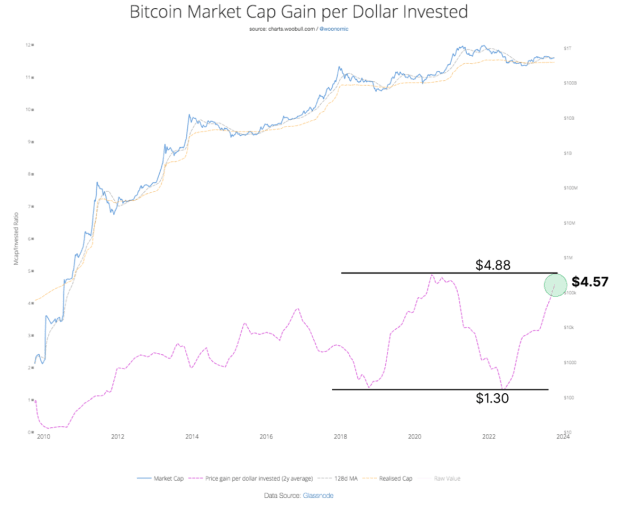

Thanks to Willy Woo’s analysis, we can measure what that will suggest to Bitcoin’s market cap within a variety.

Quantifying How ESG = NGU

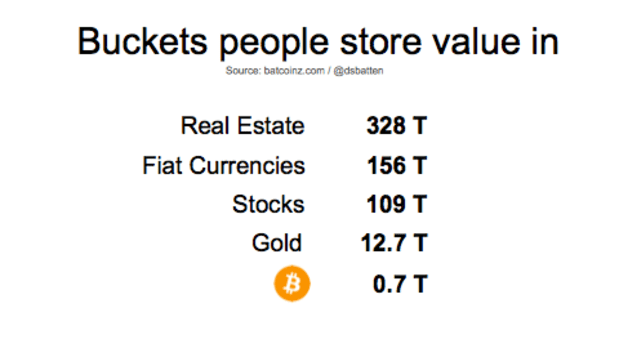

ESG adoption of Bitcoin is extremely bullish for Bitcoin’s reasonably thimble-sized market of $713Bln at the time of composing. Woo argues that Bitcoin requires to remain above 1 Tr before the organizations that hold the wealth of country states and/or retirement funds feel comfy buying it en masse.

What then would take place to Bitcoin’s market cap if ESG financiers released 1% of their 2026 AUM (Assets Under Management) into Bitcoin?”

At today’s market-cap-increase-per-dollar-invested ratio – Bitcoin’s market cap would increase to a healthy $2.26 Trillion. That’s more than triple what it is today.

If 2.5% of ESG funds AUM was released into Bitcoin, it would increase market cap to $3.87 Trillion. That’s more than 5 times today’s market cap. This puts it directly on the roadmap for institutional financiers, which causes more capital release, which in turn produces an extremely bullish favorable feedback loop.

Even without this feedback loop however, a 2.5% ESG release might catalyze a Bitcoin cost of around $193,000 throughout a possible 2026 bearishness.

This is not a forecast however a simulation. I am stating if ESG ICs released 1-2.5% of AUM, then the repercussion for Bitcoin’s market cap might be 2-5x.

That stated, Bitcoin has the special capacity of ending up being the world’s very first Greenhouse Negative market without offsets: something that would need Bitcoin mining methane mitigation on simply 35 mid-sized venting garbage dumps. Should that take place by the aggressive yet possible timeframe of 2026, I would be amazed if Bitcoin did not attain a 2.5% release of ESG financier AUM or higher.

Ignition

As if we required more verification that the winds of ESG narrative modification are swirling, just recently I spoke at the 2023 Plan₿ Forum in Lugano on the subject “Bitcoin is the World’s best ESG Asset”. I had the concept of utilizing a claim both Michael Saylor and Baseload have actually formerly made, and making it into a keynote supported with supporting information.

The recording is presently the most viewed talk from the 2023 conference on Youtube not since of any excellent prestige on my part (there were far better recognized speakers) however since as Victor Hugo when said “Nothing is more powerful than an idea whose time has come.”

Bitcoin as an ESG possession is a concept whose time has actually come. Bitcoin has actually now shown its capability to increase renewable resource capability and minimize methane emissions at a time when the world urgently requires options to both. By contrast, now Ethereum has actually moved to Proof of Stake, it can no longer help with either of these immediate requirements.

In early 2022, the majority of Bitcoiners were still attempting to “defend” Bitcoin versus ESG attacks through me-tooism such as “But Tumble Dryers use more energy than us”. But by 2023, Bitcoiners began taking the video game into the challenger’s half, with constant success. The technique of sharing fact-based reports and motivating stories about the favorable ESG case for Bitcoin is working: This year both The Hill and Bloomberg started releasing favorable press on Bitcoin mining. Positive traditional news protection surpassed unfavorable accounts 4:1. And then obviously there were those 53 days of narrative turns.

Every 4 years, a new false-narrative is hatched.

However, every 4 years, it’s also “tick tock, next false-narrative for the chopping block.”

The story that Bitcoin “destroys the environment” if not dead, is at least a Nearly Headless Nick.

The approaching halving will even more dry up Bitcoin supply while concurrently warming up financier interest. All the while, the winds of modification in the ESG narrative are getting knots. The conditions are now best for the inescapable firing up stimulate of big ESG fund release into Bitcoin.

ESG = NGU.

Daniel Batten is creator of CH4Capital, who offers facilities funding to Bitcoin mining business who are powered by vented methane from garbage dumps.

This is a visitor post by Daniel Batten. Opinions revealed are completely their own and do not always show those of BTC Inc or Bitcoin Magazine.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.