As Bitcoin develops, a notable indication of its long-lasting existence within the international monetary landscape is the considerable boost in Bitcoin Exchange-Traded Funds (ETFs). These monetary items, which supply managed and traditional access to Bitcoin, have actually brought in substantial capital from both institutional and retail financiers considering that their intro. Data assembled by Bitcoin Magazine Pro’s Cumulative Bitcoin ETF Flows Chart shows that Bitcoin ETFs have collected over 936,830 BTC to date, causing the important query: Will these holdings surpass 1 million BTC prior to 2025?

The #Bitcoin ETFs have actually currently collected 936,830 #BTC! 🏦

Will this go beyond 1,000,000 BTC before 2025? 🪙

Let me understand 👇 pic.twitter.com/UojJpJlC4P

— Bitcoin Magazine Pro (@BitcoinMagPro) December 16, 2024

The Significance of the 1 Million BTC Mark

Surpassing the 1 million BTC turning point would represent more than simply a symbolic accomplishment; it would represent significant market maturation and long-lasting rely on Bitcoin as a genuine, institutional-grade possession. A substantial amount of Bitcoin kept within ETFs constrains market supply, possibly serving as a driver for upward rate motion. As less coins appear on the exchanges, the characteristics of long-lasting market balance might move, favorably affecting Bitcoin’s flooring rate while decreasing disadvantage volatility.

The Trend Is Your Friend: Record-Breaking Inflows

The momentum surrounding Bitcoin ETFs is unquestionable. In November 2024, Bitcoin ETFs skilled record inflows surpassing $6.562 billion—over $1 billion more than the figures from the previous month. This increase considerably outmatches the rate of Bitcoin production; in November alone, just 13,500 BTC were mined, while over 75,000 BTC streamed into ETFs, showing a supply-demand dynamic of 5.58 times the regular monthly supply. Such patterns highlight the deficiency element that presently impacts the marketplace. When need substantially surpasses supply, the natural market action tends to develop upward pressure on costs.

A Chart of Insatiable Demand

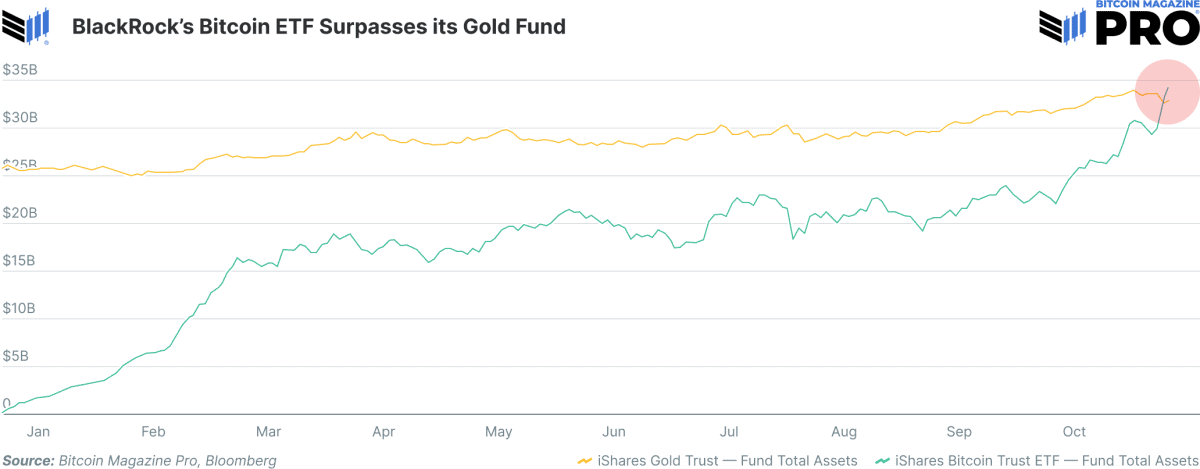

A landmark event unfolded as BlackRock’s Bitcoin ETF just recently exceeded its own iShares Gold Trust in overall fund possessions, a minute showed in the November edition of The Bitcoin Report. This shows a clear pattern of moving financier choice; for years, gold held the position of the main “safe haven” possession, while Bitcoin progressively develops itself as the “digital gold.” The unwavering cravings for Bitcoin-backed ETF items highlights a growing acknowledgment amongst both experienced experts and brand-new financiers concerning Bitcoin’s possible function as a fundamental component in varied financial investment portfolios.

Long-Term Holding and Supply Shock

A substantial function of Bitcoin ETF inflows is the disposition for long-lasting financial investments. Institutional buyers and long-lasting financiers tend to take part in less regular trading, rather choosing to get Bitcoin through ETFs and keeping their holdings over extended durations—possibly covering years or years. This continuous pattern efficiently gets rid of Bitcoin from blood circulation, causing a steady decrease in offered supply on exchanges, which might culminate in a prospective supply shock.

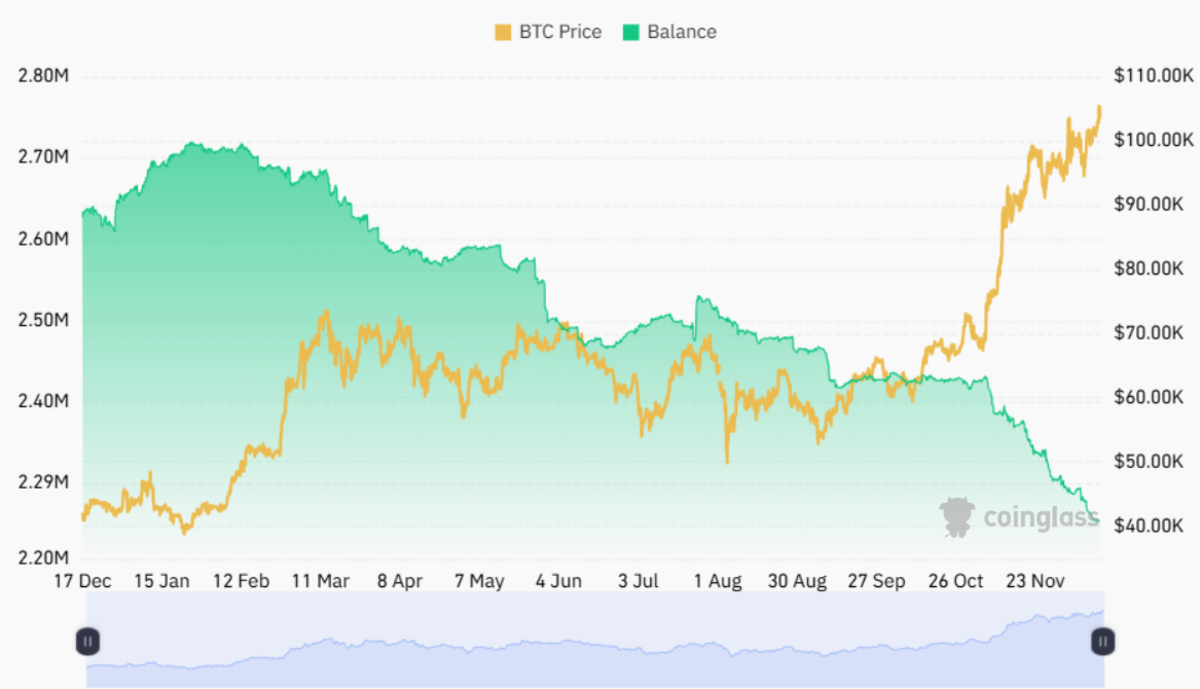

This pattern is validated by current information from Coinglass, showing that just about 2.25 million BTC stays available on exchanges, marking a consistent slump in offered supply. The information shows a divergence: as Bitcoin’s rate continues to increase, the balance of Bitcoin on exchanges reduces—an apparent signal of the underlying deficiency characteristics at play.

A Perfect Bitcoin Bull Storm and the March Toward $1 Million

The dominating market characteristics have actually currently driven Bitcoin past the $100,000 limit, with such achievements possibly ending up being remote memories. As the marketplace gets used to what might be a journey towards $1 million per BTC, this as soon as lofty goal now appears progressively possible. The mental “multiplier effect” recommends that an increase of significant purchasers can activate a wave of purchasing activity, culminating in explosive rate boosts. With ETFs constantly collecting possessions, each considerable purchase might prompt a domino effect, as financiers prepare for missing out on the next market rise.

Incoming Trump Administration, the Bitcoin Act, and a U.S. Strategic Reserve

In addition to existing bullish patterns, a possibly transformative geopolitical circumstance is emerging. President-choose Donald Trump has actually shown assistance for the “Bitcoin Act,” a proposed legislation directing the Treasury to develop a Strategic Bitcoin Reserve. This effort would require divesting part of the U.S. federal government’s gold reserves to get 1 million BTC—roughly 5% of the all offered Bitcoin—with the intent of holding the possessions for twenty years. Such a tactical maneuver would represent a seismic shift in U.S. financial policy, placing Bitcoin as a property of nationwide wealth equivalently together with or going beyond gold.

With ETFs currently adding to deficiency, a U.S. federal government effort to protect a considerable Bitcoin reserve would worsen these results. Considering that just 2.25 million BTC is presently offered on exchanges, if the United States were to pursue almost half of that volume within a reasonably brief period, the resulting supply-demand imbalance would be remarkable. This circumstance may start a hyper-bullish pattern, raising Bitcoin’s rate to unmatched levels. Under these conditions, even a cost point of $1 million per BTC may be considered as a sensible forecast, reflective of Bitcoin’s broadening function in international financing and as a nationwide tactical reserve possession.

Conclusion: A Confluence of Bullish Forces

The merging of short-term ETF inflows surpassing recently minted Bitcoin by an element of 5, combined with possible long-lasting shifts like the facility of a U.S. Bitcoin reserve, shows that the basics are progressively beneficial for Bitcoin. The continuous deficiency, in addition to the multiplier result produced by big financiers getting in the marketplace, leads the way for significant rate gratitude. What was as soon as dismissed as unlikely—a Bitcoin rate reaching $1 million—now inhabits the world of possibility, supported by concrete information and engaging financial forces.

The journey from existing assessment levels to a brand-new date of Bitcoin rate discovery includes more than simple speculation. It is grounded in tightening up supply, unwavering need, increasing institutional approval, and the possible recommendation of the world’s biggest economy. In this context, surpassing 1 million BTC in ETF holdings before 2025 might simply declare the start of a wider story—one that has the possible to redefine international financing and reassess the very nature of reserve possessions.

For the most current insights on Bitcoin ETF information, regular monthly inflows, and establishing market characteristics, please describe Bitcoin Magazine Pro.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.