Bitcoin is concluding among the most amazing months in its history, experiencing a rise surpassing $30,000 in November, consequently indicating a restored bullish belief within the marketplace. As observers turn their attention to December and beyond, financiers are acutely thinking about examining whether Bitcoin’s momentum can be kept through to 2025. With macroeconomic elements, historic patterns, and on-chain information presently lining up positively for Bitcoin, a comprehensive analysis of the scenario and its ramifications for the future is called for.

November’s Record-Breaking Performance

November 2024 was not a common month; it marked a historical duration for Bitcoin. The cryptocurrency’s price intensified from roughly $67,000 to almost $100,000, showing an approximate 50% peak-to-trough boost, which made up the best-performing month in regards to dollar gains in Bitcoin’s history. This rally showed to be beneficial for long-lasting holders who withstood a number of months of market debt consolidation following Bitcoin’s all-time high of $74,000 earlier in the year.

View Live Chart 🔍

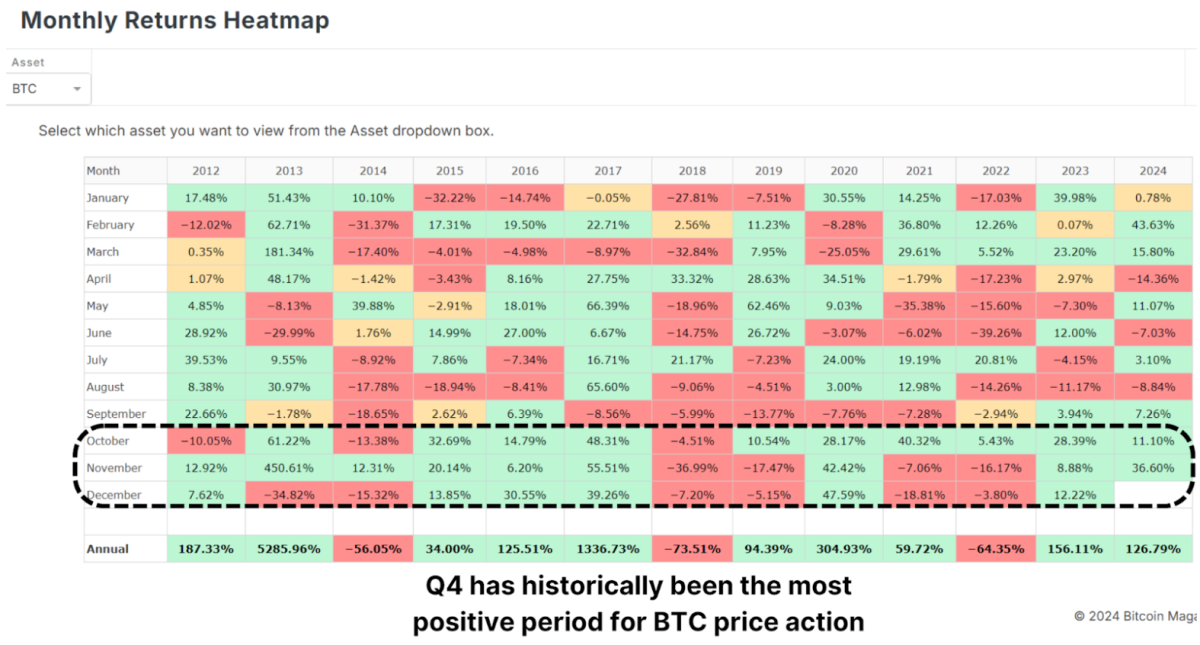

Historically, the 4th quarter has actually been Bitcoin’s greatest duration, with November typically becoming an especially noteworthy month. December, which has also revealed strong efficiency in previous bull cycles, appears to provide an appealing circumstance. However, as is normal with any market rally, some degree of short-term cooling need to be expected.

View Live Chart 🔍

The Role of the Dollar and Global Liquidity

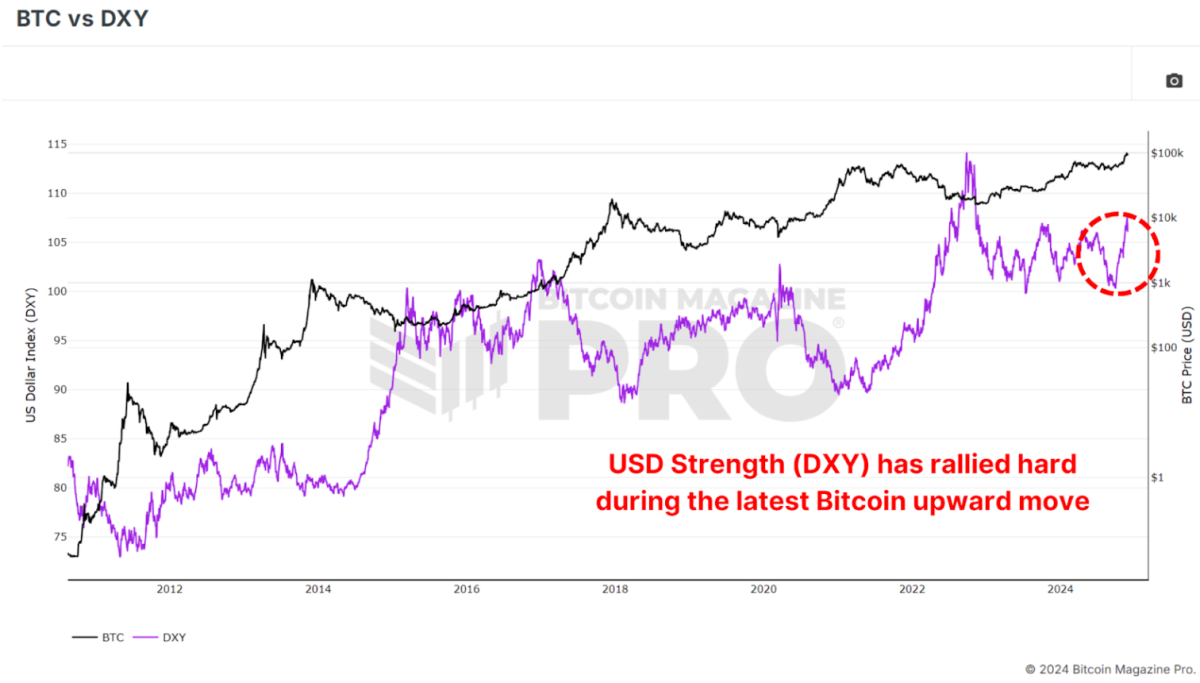

Notably, Bitcoin’s price climb has actually taken place versus the background of a reinforcing U.S. Dollar Strength Index (DXY), a circumstance that generally leads to underperformance for Bitcoin. Traditionally, Bitcoin and the DXY have actually kept an inverted connection: a more powerful dollar typically results in a weaker Bitcoin, and vice versa.

View Live Chart 🔍

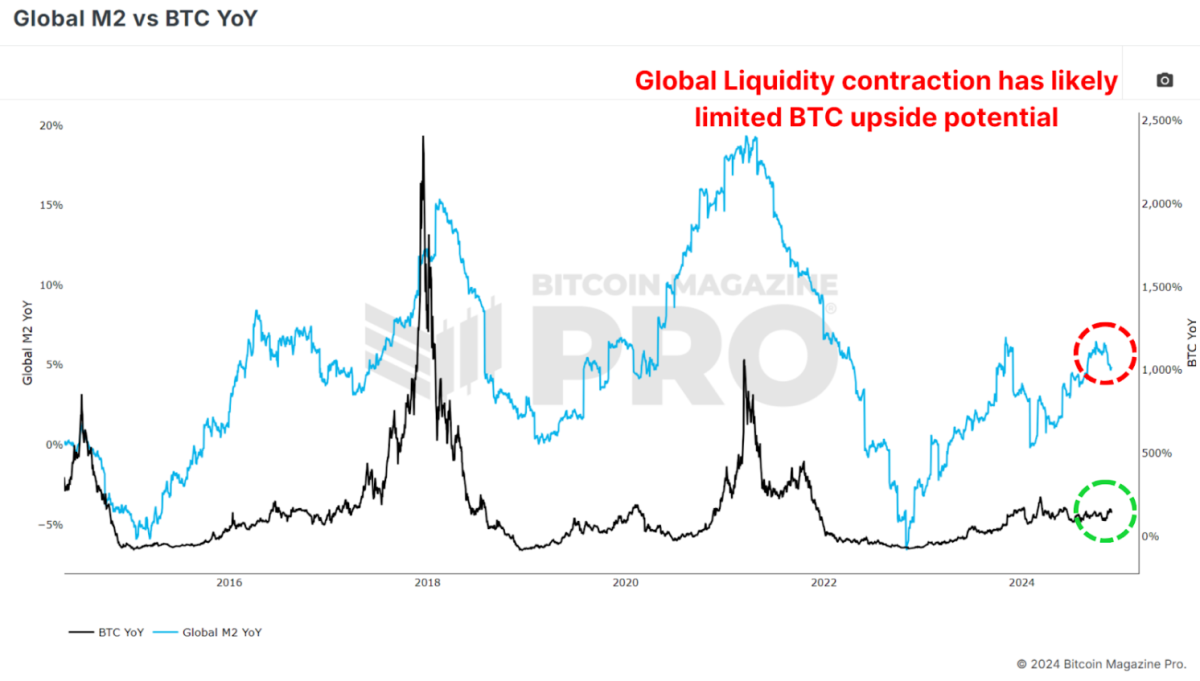

Additionally, current information suggests a minor contraction in the Global M2 cash supply, another important metric. Historically, Bitcoin has actually shown a favorable connection with worldwide liquidity; therefore, its strong efficiency in the existing financial environment is rather unforeseen. Should liquidity conditions enhance in the coming months, it might act as a significant tailwind for Bitcoin’s price.

View Live Chart 🔍

Parallels to Past Bull Cycles

The existing trajectory of Bitcoin carefully looks like that of previous booming market, especially the cycle from 2016 to 2017. This earlier cycle begun with progressive price boosts before breaking through considerable resistance levels, causing a rapid development stage.

In 2017, Bitcoin’s price rose from an important technical limit of roughly $1,000, culminating in a parabolic rally that peaked at $20,000, representing a 20-fold boost. In a comparable vein, the 2020-2021 cycle saw Bitcoin increase from $20,000 to almost $70,000 following its breach of an essential year-over-year efficiency limit.

View Live Chart 🔍

If Bitcoin can decisively break through this historical level, surpassing the crucial $100,000 mark, it is imaginable that a comparable explosive price motion might take place as Bitcoin goes into a rapid stage of bullish price action.

Institutional Adoption and Accumulation

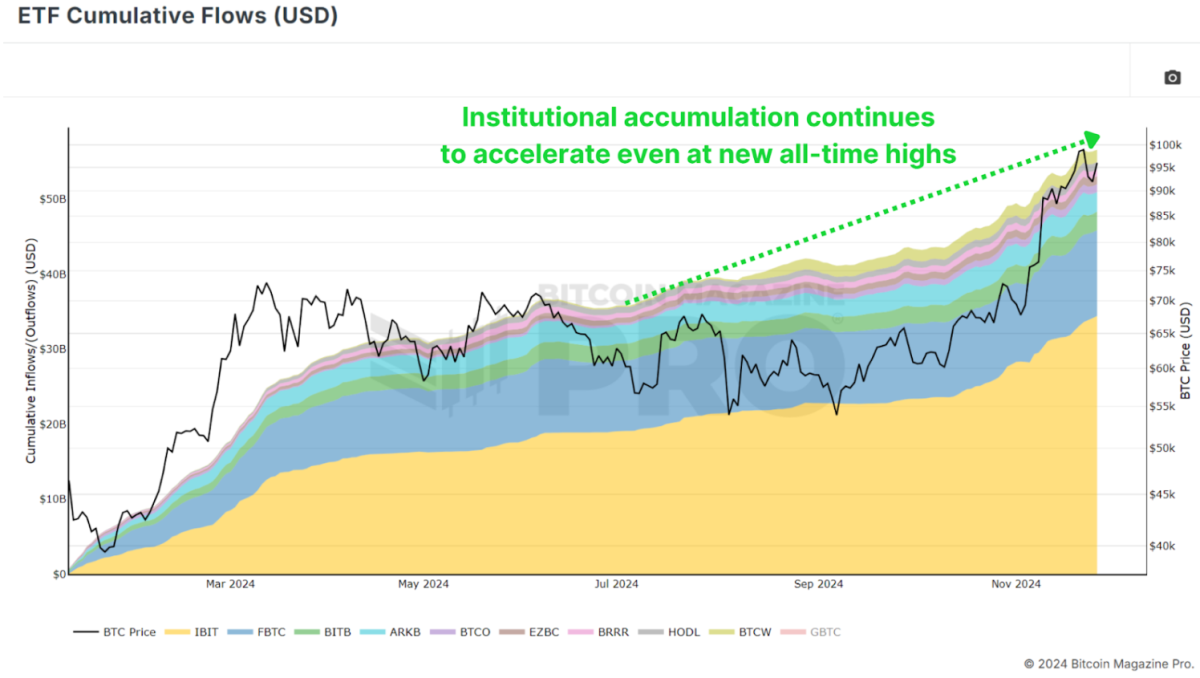

A substantial aspect adding to Bitcoin’s existing strength is the continuous build-up by institutional financiers. A growing variety of Bitcoin exchange-traded funds (ETFs) are including billions of dollars in BTC to their portfolios. Notably, corporations such as MicroStrategy have actually strengthened their Bitcoin techniques, collecting almost 400,000 BTC. Even as Bitcoin reaches brand-new all-time highs, institutional financiers—typically described as ‘smart money’—aspire to build up as much Bitcoin as possible, to prevent losing out on prospective gains.

View Live Chart 🔍

This institutional build-up shows an increasing self-confidence in Bitcoin as a long-lasting shop of worth, even in the middle of unpredictable market conditions. Such need also restricts the offered supply, which in turn puts in upward pressure on rates as need intensifies.

Conclusion

While December has actually traditionally been a robust month for Bitcoin, short-term volatility might temper prospective gains as the marketplace soaks up the sharp rally experienced in November. Nevertheless, offered the aggressive build-up observed amongst institutional individuals, a range of results stay possible.

In the longer term, nevertheless, the outlook stays incredibly bullish. The important level to keep track of is $100,000, which represents the next considerable turning point; if exceeded, it might lead the way for a more comprehensive rally in 2025. Bitcoin appears poised to start among its most amazing stages yet, with beneficial positionings apparent throughout macroeconomic, technical, and on-chain metrics.

For those thinking about diving deeper into this subject, a current YouTube video entitled “The BIGGEST Bitcoin Month EVER – So What Happens Next?” supplies more insights.

🎁 Black Friday: Our Biggest Ever Sale

The most significant cost savings of the year are now offered. Enjoy 40% Off all yearly strategies.

- Unlock over 100 Bitcoin charts.

- Access Indicator informs to guarantee you never ever miss out on crucial advancements.

- Utilize personal TradingView indications for your preferred Bitcoin charts.

- Receive members-only reports and insights.

- Anticipate numerous brand-new charts and functions coming quickly.

All this for simply $15 each month with the Black Friday offer. This represents the biggest sale of the year.

UPGRADE YOUR BITCOIN INVESTING NOW

Don’t lose out! 👉 https://www.bitcoinmagazinepro.com/subscribe/

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.