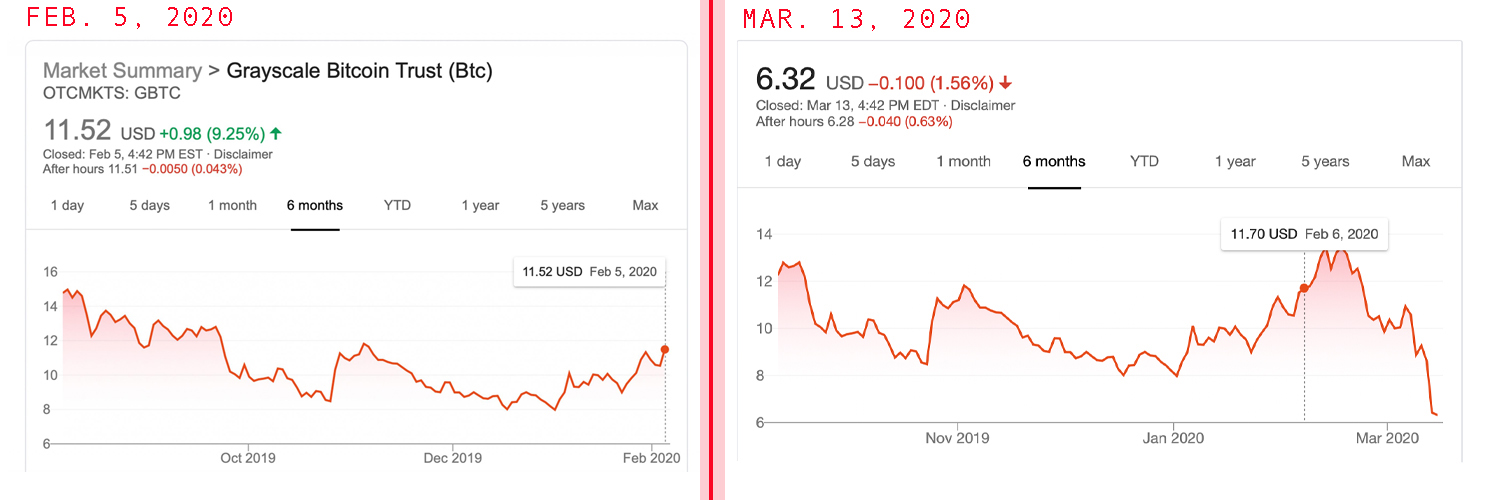

Prior to the marketplace carnage on March 12, the Grayscale Bitcoin Trust (GBTC) had actually obtained over 300,000 BTC. Grayscale’s trust has actually been among the longest-running FINRA authorized financial investment cars with bitcoin possessions under management. On Feb. 5, GBTC shares climbed up more than 10% that week and financiers were also paying a 20-30% premium. Since then and after the marketplace decline on Thursday, GBTC shares are down 45% from $11.52 to $6.32 per share.

The Grayscale Bitcoin Trust Holds More Than 300,000 BTC

When individuals examine the cost ticker typically they are assessing the cost from among the wide varieties of crypto area exchanges worldwide. They notification that the cost has moved substantially, however what they frequently put on’t see is the unfavorable results on other parts of the market. The market carnage on Thursday saw huge derivatives liquidations, margin calls from lending institutions, and exchange-traded crypto items felt the rage.

The Grayscale Bitcoin Trust (OTCMKTS: GBTC) was one financial investment automobile struck hard by the storm. News.Bitscoins.web reported on GBTC on Feb. 5, 2020, when shares were trading for $11.52 per share. A couple of weeks later on, it was reported that GBTC held more than 300,000 BTC under management ($1.5 billion). Three days earlier on Reddit, a single person found the trust just recently crossed the 300K BTC mark and specified:

By March 10, GBTC provided 311,309,400 shares which is comparable to 300,619 BTC. This indicates GBTC financiers included 39,570 BTC to their holdings.

‘A Solidified Role as a Store of Value’ and Grayscale’s Drop Gold Campaign

March 10 was right before the assault on crypto markets that happened on Thursday and GBTC was trading for $9.26 a share. Today, after Thursday’s market havoc, GBTC is down 31.7% considering that March 10 and 45% down considering that our report in February. Moreover, on March 2 the handling director of Grayscale Investments, Michael Sonnenschein, informed The Compound that BTC is a “flight to security.”

“Bitcoin itself has actually strengthened its function as a shop of worth or as a digital gold,” Sonnenschein informed the press reporter. “So I speak with an organization, they now take a look at bitcoin as part of the exact same flight to security as they may take a look at bonds or gold or other things that have actually served because capability for them, which wasn’t a widely-held story most likely till about the last 12 or 18 months.”

During the course of 2019, the crypto market was filled with talk of institutional interest signing up with the BTC economy. Last May, Grayscale began a multi-million dollar marketing project called “Drop Gold.” The project consisted of a year-long run of aired commercials on nationwide tv in the U.S. and the industrial programs gold financiers being restrained by the cumbersome old metal.

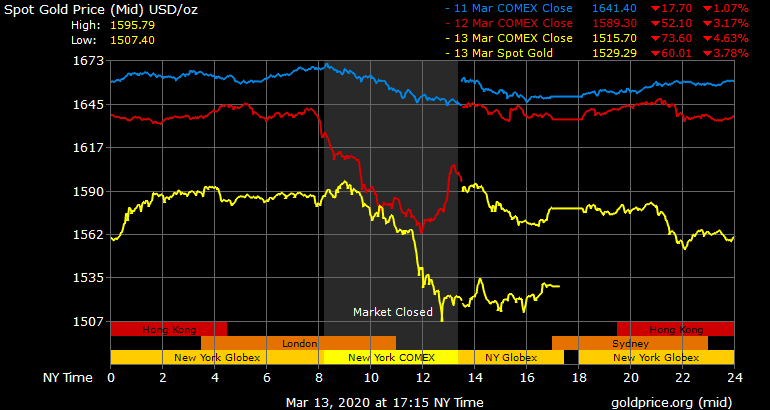

Ever considering that the stock exchange crashed on March 12, gold costs have actually dipped in worth after touching all-time highs together with numerous rare-earth elements markets. In truth, on Friday gold costs lost 4.5% and the metal deals with the most significant weekly loss considering that 1983. Financial press reporters Myra Saefong and Mark DeCambre detailed on March 13, that “gold futures [saw the] biggest weekly loss in more than 8 years.” Gold did see huge trade volume and the U.S. Mint just recently offered out of American Silver Eagle coins. Even though gold has actually taken a significant hit throughout the last couple of days, percentage-wise it’s done much better than BTC throughout the existing financial crisis.

Have Institutional Investors Left the Crypto Building?

BTC area costs today reveal combination and a couple of minor gains throughout the late afternoon trading sessions on March 14. If BTC costs continue to increase throughout Sunday’s trading sessions, then GBTC shares will likely see a lift in worth on Monday. Despite the marketplace decline, individuals believe that institutional financiers have actually stayed while others think they have actually left crypto markets. “The reports are institutional financiers activated the bitcoin waterfall,” one crypto supporter tweeted on Saturday. “Today shows that organizations purchasing Bitcoin has an other side,” tweeted Jimmy Song 2 days prior. During his interview Grayscale’s handling director Sonnenschein stated that BTC as a possession class won’t be disappearing at any time quickly.

“There is ever-growing proof that this property class is not disappearing — financiers desire access to it, and if the tradition organizations wish to stay competitive, they’re going to need to unlock to this property class for their customers,” Sonnenschein stated.

What do you think of Grayscale keeping 300K BTC under management? Do you believe institutional financiers are still thinking about bitcoin after the marketplace carnage on Thursday? Let us understand what you think of this topic in the comments area below.

Image credits: Shutterstock, Grayscale.co, Google Stocks, Goldprice.org, Youtube, Fair Use, Wiki Commons, and Pixabay.

Thank you for visiting our site. You can get the latest Information and Editorials on our site regarding bitcoins.